What is Inflection Point Ventures? What is its purpose?

IPV is an angel investing platform with 23,500+ CXOs, HNIs, Premier Institution Alumni and Professionals investing in start-ups and supporting founders with experiential capital to accelerate growth. IPV is one of India’s largest and fastest growing angel investment platforms.

IPV has screened over 24,533 start-ups, of which we have invested in 270+ start-ups, exited 18, 32 partial exits and made 87 follow-on investments as of Sept’25.

Our investment philosophy

It is our objective to showcase those start-up investment which are great businesses, run by great founders, raising funds at reasonable valuations. These parameters are scorecard prepared for every opportunity presented to members for investment commitment. The opportunities are agnostic to stage of funds raise, quantum of raise and sector in which the start-up operates.

What is unique about IPV and therefore how is this going to be different from other investing forums?

As a further elaboration of point number 1, the USP and related advantages are laid out below:

- Diverse network of 23,500+ distinguished CXOs, HNIs, Premier institution alumni & senior professionals, spanning across various geographies, industries and areas of expertise, that are available real time to evaluate any given startup (e.g. Due diligence, Funding, Business Knowledge, Mentoring and solving various other problems).

- Low cost to be a part of the network, given distributed nature, which would be almost half of any other significant angel group.

- Higher chances of success, as the evaluation is done by experts in the fields of business, investing as well as functional area. Whilst 90% of the startups fail, as of April’25 only ~10% of IPV’s portfolio, by value, have failed.

- Ability to start investing with smaller sums as the funding is pooled by the group, still making it meaningful for a given startup.

- Ability to help the startup grow and take them to the next level by providing them additional access to customers, guidance and mentorship along with funding. All invested members / shareholders are collectively responsible to monitor the investment and provide inputs to the founder as required, through the Startup investor partnership (SIP) calls or LetsGrow program.

Ability to refer startups that are already known to this forums’ members, and giving them an opportunity to do a proprietary deal.

Are there certain principles of investing that this forum expects to follow?

Startup investing is risky. To minimize the risks, we need a clear investment approach. We propose using a set of established investing principles based on extensive literature. IPV is a platform that connects investors and founders, and it adds an extra layer of due diligence through IPV and its associates, including input from the investor community.

These principles will be included in evaluation sheets (scorecard and valuation summary) prepared by IPV analysts for investors. It’s important to note that IPV does not provide specific recommendations for investing or not investing in a startup. The documents reflect the analysis and confidence of the respective Lead/Co-Lead/experts. They consider the startup’s past financial performance, future projections, and estimates shared by the startup.

What are the various initiatives through which a member can choose to invest?

It caters to a diverse group of investors, by providing opportunities to invest through its various initiatives:

- Main Bhi Angel (MBA): An initiative to break the notion that startup investing is only for folks with deep pockets. It provides an avenue to start exploring this asset class in one’s portfolio with a ticket size as low as INR 1 Lakh.* It also allows a new investor to start with a small investment, while still making a meaningful value proposition for the startup with combined funding from various members.

- Premier / premier select Program: To provide enhanced flexibility to investors who due to travel, work commitments or time-zone constraints are unable to fill the commitment form, the Premier program* has been curated. This program enhances access to a wider array of startups to be brought to the IPV platform.

- IPV Ultra Plan: IPV Ultra is an elite investor club launched by Inflection Point Ventures for a limited set of serious, forward-looking investors who want privileged access to India’s most exclusive startup opportunities. These are select, scarce opportunities that are backed by the top VCs of the country .

- Individuals looking to co-invest alongside top tier venture capital funds.

- Investors who don’t have the time to evaluate deals themselves and require support in high

- quality deal selection. Investors who want the benefits of VC investing but at lower ticket size and cost

How can I upgrade my membership or become a premier select member?

The membership status is upgraded as Premier select soon after the signature of all the 3 parties on the (CA) contribution agreement for the fresh contributor or the premier select addendum for the existing AIF contributor. Post onboarding any draw down notice for fund transfer for the past or upcoming committed deals would be governed as per the new agreement submitted to SEBI where the class of units assigned will be class E and carry fee will be applicable as per the addendum signed.

What is the structure of transaction in an investment made by an IPV Investor?

Investors can choose to invest via any of the two methods below:

- Direct: Any member can invest directly with the startup and will hold shares directly. The transaction, terms and conditions would be directly between the member and the startup (with guidance from the core leadership team of IPV), example: Standard Term sheet, Valuation, Evaluation Sheets etc. However, there are certain restrictions with this method. There can be only 200 investors on the captable and many times startups already have a large number of investors onboard. Direct captable entry is cumbersome for NRIs with RBI compliances on FCGRP filings, which is dependent on the expertise the founder may have. Exit process also becomes tedious, depending on investors complying to timelines.

- AIF: To address the limitations arising out of the direct investment structure and making it a smoother experience, IPV introduced CAT-I Angel Alternative Investment Fund (AIF), which is governed by SEBI. The trust is named FirstPort Capital, which is a pooled vehicle to collect funds from investors, whether Indian or foreign, for investing in start-ups through an investment

How do I evaluate if I should join the forum or not? Is the forum meaningful for me?

As an extension to question number 2, you could evaluate being a part of this forum if you are serious about one or more of the following objectives:

- Want to learn from peers about how to evaluate startups and investing in general.

- Want to create wealth through investing in startups.

- Want to teach and share your knowledge, expertise and experience related to investments with other members of the forum.

- Want to test your entrepreneurial skills while mentoring and guiding startups in various aspects like solving challenges, scaling up etc.

- Want to evaluate a startup as an innovative solution provider either for your business or the investors personally.

Are there any charges for the membership or is it free?

The idea is to keep the costs as low as possible, while still making the initiative sustainable. Being a professional group, meant for investors who can identify “Value in any given initiative/startup”, the costs would need to be shared among the members as annual membership fee. The fee would include the cost of the analyst, support staff, IT platform/infrastructure as required, hiring consultants etc, and also cover for admin expenses such as networking event expenses.

Currently, the Annual Membership Fee is Rs.33800+ 18% GST (Rs.39,884) subject to annual revision. We have multi-year plans with discount and Auto debit mandate plans* to lock in your membership fee with the discounted price for long term. Please note that the membership fee is non-refundable.

*Please get in touch with your Relationship Managers to explore these options.

Investment Documentation Fee is 2% of the amount invested in any IPV startup and Investment Exit Documentation Fee is 2 % of the total sales value in any IPV start-up. Fees differ for Premier and Premier plus/Premier Select members. Please reach out to your Relationship Manager for further details.

For regular members, under direct investments via the IPV platform there is no carry fees on Exits. For investments under specified class(es) via the AIF (First Port Capital), carry fees on Exits would be applicable as per the relevant class(es) applicable.

How does one become the member of the forum?

You can download the IPV App: http://onelink.to/ymbp8e, a relationship manager will be assigned to you. Alternatively, you can fill up your details on our website https://ipventures.in/contact/. If you know someone as a member of the forum, they can refer you to us as well.

Can I take a Trial Membership to test and experience the platform?

Yes, you can avail the trial membership, and the details are given below:

- You will have access to webinars & startup pitch calls that are held on weekly basis (Wednesday & Saturday)

- You will be added to a separate trial members group and not the investors group (paid members group)

- Paid membership is mandatory to be able to make an investment. Also, any member who is due for renewing his membership in the next 1 month, must have a valid 12-month membership, before investing in any startup.

- The trial membership period will last for 30 days. Post that you will need to choose your membership to be able to continue.

I am new to investing. Are there certain books that I should read to get myself up to speed?

Yes, we strongly advise that one gets to understand the basic tenets and principles of Investing. The following books are highly recommended for anyone wanting to learn investing concepts and evaluating startups.

- Zero to One: Notes on Startups, or How to Build the Future by Peter Thiel (founder of PayPal)

- Hot Seat: The Startup CEO Guidebook by Dan Shapiro

- Buffett Beyond Value by Prem Jain

- The Intelligent Investor by Benjamin Graham

- The Little Book of Common-Sense Investing by John C. Bogle

- The Outsiders by William Thorndike

- Common Stocks and Uncommon Profits by Philip A. Fisher

- The Millionaire Next Door by Thomas J

- The Snowball by Alice Schroeder

- Stay Hungry, Stay Foolish by Rashmi Bansal

- The Lean Startup by Eric Ries

- Think and Grow Rich by Napoleon Hill

- The Startup Playbook: Secrets of the Fastest-Growing Startups by David Kidder

- The Millionaire Next Door by Thomas J. Stanley

- Rich Dad Poor Dad by Robert Kiyosaki & Sharon Lechter

What privileges / services should I expect as a paid member of IPV?

IPV provides the following benefits to its members:

- Access to evaluation reports prepared by IPV’s in-house analyst team.

- Access to investing in a wide array of startups. We’re sector agnostic.

- Access to startup pitches and webinars: Given the scope of the activities and keeping in mind the wide geographical spread of our members, we meet virtually via our Startup Saturday Webinars and Wonder Wednesday every week. This would help in saving travel time as well as enable participation of members across various geographies.

- To enable members to track the performance, IPV organizes Startup Investor Partnership (SIP) calls to engage with the founders on a periodic basis. This is available to subscribers only. IPV does not charge management fee and is not responsible to track the progress of investments. Interested members can also volunteer to help the start-up through the LetsGrow program and receive updates directly from founders.

- Bot Services: IPV has Bot services for its members. Which helps you be independent and seek information, documents, agenda and updates for your deals. There are Bot numbers, one which provides you details of IPV startups. Other gives you updates of your investments in various deals. Your RM can guide you further on this.

- IPV’s own App: Access information at your fingertips. Details in Annexure: Communication Guidelines in this document.

- Membership Rewards Program: Members can earn points for investing, referring new members, helping startups, providing mentorship time etc. The points can also be redeemed to pay for the annual subscription charges. Details regarding membership rewards program are mentioned in the membership note. For CXO Genie members, you can use your CXO Genie points for ‘IPV membership’ related costs as well.

- Privileges for Premier*, Premier Select* and Ultra* are over and above these privileges.

*Please contact your RM for further information.

When and where does the members’ group meet?

Every year in April, IPV organizes an online event for all its members from across the globe, called as Rendezvous. Every year we have a renowned accomplished individuals at the event to share their own journey. In the past we have had Sanjeev Bikhchandani, Ronnie Screwvala, Rajan Anandan, Shekhar Kapur. In addition, IPV shares its annual performance update, successes and failures, new initiatives and opens the forum for any question you may want to ask.

We also organize regional meets, in three major hubs: Mumbai, Bangalore, Gurgaon as well as key cities like Pune, Chennai, Hyderabad, Surat, Ahmedabad, to enable networking, to know other fellow investors, meet IPV founders and team.

As IPV expands its horizon outside India we have initiated our IPV connects in Singapore and Gulf regions such as: Dubai, Riyadh & Oman as well.

Does IPV get all deals in the market?

It is IPV’s philosophy to showcase to its members, investment opportunities in exceptional businesses led by outstanding founders, raising funds at reasonable valuations. A curated list of selection panellist, including industry experts and CXOs, thoroughly evaluate a startup’s proposition before presenting them to members on a founder’s call. It is possible that some popular start-ups presenting on other platforms may not be presented on IPV if they do not meet the selection criteria. On the other hand, there have been start-ups rejected by other platforms but selected and invested in by IPV members, resulting in significant returns. As of now, IPV does not have an anti-portfolio.

Who is responsible to select start-ups?

The responsibility of selecting start-ups is a collective and collaborative process. IPV is a platform of angel investors, and the selection panel consists of members who are invited based on their level of participation on the platform, including gold and silver tier members, industry experts, CXOs, experienced investors, and volunteers. The selection panel reviews start-up proposals, shares insights, and suggests whether a start-up should be further evaluated or not. It is a democratic process where multiple perspectives are considered to make the final selection decisions.

Can I refer startups I have invested in earlier, or if I know the founders?

Any IPV Investor can refer a startup, provided they know the founders personally. Members can refer a startup at: ipventures.in/contact-us/startup/. The founders and the startup will then be reviewed by the selection panel, which will evaluate the given startup on a defined set of evaluation criteria. The startup will need to go through the entire journey of evaluation to be able to raise funds through IPV. IPV is industry agnostic and believes in equal opportunity.

How should I position IPV to the founders for them to raise their funding from this forum?

IPV offers multiple unique benefits to startups and the below can be your pitch to them (you can also request funding@ipventures.in for a detailed note that has been prepared, to be sent to the startup):

-

- Ability to raise funding from a set of mature and seasoned investors with diverse professional experience in handling businesses.

- Opportunity to get advice and mentorship from experts in an area they need help in. (e.g. Scaling up, Legal advice, Advice on business operational issues, HR matters, Talent acquisition etc.)

- Help in early identification and solutioning for potential roadblocks and risks. Opportunity to get best practices from the industry.

- Opportunity to get CXOs as their retail customers and make them their ambassadors.

- Opportunity to get corporate/B2B customers as the forum represents various CXOs of businesses across industries.

Why is the pass rate for startup funding requests so low?

The pass rate at IPV is low due to the stringent selection criteria in place. IPV aims to invest in start-ups led by great founders who are running excellent businesses and are available at reasonable valuations. The start-ups undergo a thorough diligence process based on the feedback provided by the selection panelists before the founder’s call. Additionally, all members participating in the founder’s call provide their feedback through a feedback report.

Furthermore, IPV has a robust due diligence process led by IPV Partners and Select members. They, along with Co-lead members, independently build their conviction about the start-ups and commit to investing in the ones presented to the members. This independent conviction-building process may result in some popular start-ups not being invested in by IPV. However, it also means that there are instances where IPV invests in start-ups that might have been rejected by other platforms. The low pass rate reflects the rigorous evaluation and selection process aimed at identifying promising start-ups that align with IPV’s investment criteria.

Why do I not get to see all deals? How can I become a Selection Panelist?

As an IPV member, you may not get to see all deals for several reasons. The IPV selection panel reviews hundreds of start-ups on a weekly basis. This panel consists of IPV team members as well as members invited from the Gold and above tiers. If you hold a Gold or above status and wish to be part of the selection panel, you can express your interest through your RMs. However, it is important to note that the decision to onboard volunteers to the selection panel ultimately rests with IPV, and they have the sole discretion in this matter. Therefore, not being able to see all deals may be due to the limited capacity of the selection panel and the discretion exercised by IPV in determining its composition.

How is investment valuation determined?

The investment valuation in IPV is determined through a negotiation process between IPV and the founders of the start-up. The specific details and multiples related to the valuation are mentioned in the Valuation Summary, which is provided to the members on the Investment Commitment Call. This document, along with the Scorecard, is shared with the members at least three days prior to the call, allowing them time to review and make an informed decision. Additionally, a Business and Financial Summary is shared 24 hours prior to the call, providing further details to facilitate members in their decision-making process. For further guidance and insights on valuation, members are encouraged to refer to the Masterclass on valuation provided by IPV.

It’s important to note that investors have the right to choose and are responsible for their investment decisions regarding deals presented by IPV. Once investors have made their investment, they cannot hold IPV responsible for the negotiated valuations. If the valuation of a particular deal does not align with their preferences, investors have the option not to invest. Each investing member should apply their own reasonable judgment based on their risk appetite and understanding of the business before making an investment decision.

At what stage of the start-up does IPV invests?

IPV is open to invest in deals at all stages such as PreSeed, Seeds or Series A . IPV has also started investing as early as idea stage as well with the initiation of IdeaSchool.

What are IdeaSchool deals?

IPV Idea School is IPV’s exclusive cohort program designed to provide funding opportunities to Pre-Seed to Seed-stage startups. We introduced a nation wide 6 week program for enthusiastic entrepreneurs, granting the masterclasses by industry experts and numerous other benefits. We will be holding IdeaSchool Cohort twice a year.

What benefits does investor get in investing in IdeaSchool Deals offer?

By investing in Idea School you get to invest in top 5 early stage start-ups highly curated from 1000+ start up at a lucrative valuation.

What is a premier deal and who can invest in these deals?

Deals which come with limited allocation and high in demand are classified as premier deals. All premier deals are AIF deals only and a premier or premier select member can invest in these deals to manage over subscription.

Does IPV recommend investing in the start-up?

IPV does not provide a recommendation to invest or not invest in a startup. IPV operates as a platform that connects investors with founders, adding an additional layer of due diligence performed by IPV and its associates, including assistance from the investor community. The documents shared with the members, such as the Valuation Summary, Scorecard, and Business and Financial Summary, represent the analysis and conviction of the respective Lead, Co-Lead, and experts involved in the evaluation process. These documents are based on factors such as past financial performance, future projections, and estimates provided by the start-up.

It is emphasized that each investing member should exercise their own reasonable judgment, considering their risk appetite and individual understanding of the specific business, before making an investment decision. IPV does not provide explicit recommendations but provides information and insights to assist members in their decision-making process. Ultimately, it is the responsibility of each investor to evaluate the opportunity and make their own informed investment choices.

Does IPV invest in the deals it presents?

IPV provides a platform through its app and WhatsApp groups to facilitate smooth coordination between investors for investment or exit purposes. These channels of communication are set up by IPV to aid collaboration among members. However, IPV is not responsible for any delays in investment or exit decisions made by individual members. It is also not accountable for missed opportunities if a collective majority of members agrees and subscribes to specific events.

The platform available to members for communication are:

| Type | Platform available |

| Investor queries to IPV | Members can raise their queries through the “Raise a query” section on the IPV App or participate in “Ask me Anything” Zoom sessions with IPV founders. |

| IPV communication to Investors | IPV shares updates and information through various channels such as deal-specific WhatsApp groups (managed by administrators only), BOT, App postings, emails, and communications with relationship managers. |

| Investor interaction with founders | Start-up Investor Partnership Calls are organized for investors to directly interact with founders. Additionally, deal-specific LetsGrow WhatsApp groups serve as a platform for collaboration between investors and founders. |

| Investor, IPV, Start-up collaboration | Deal-specific LetsGrow WhatsApp groups are used for collaboration among investors, IPV, and start-ups. |

| Investor to Investor | Communication between investors is not monitored or managed by IPV. Members can discuss specific points during Start-up Investor Partnership Calls. |

It is important to note that the provided communication platforms serve as tools for interaction, but the decisions and actions taken by individual members are their own responsibility.

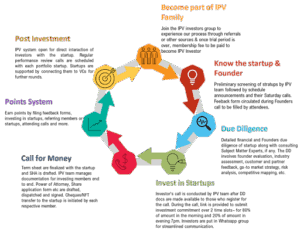

What is the broad overview of the whole process to be followed under the initiative?

What are the obligations to invest for the IPV investors?

While IPV presents its Due Diligence findings during the Investors’ call, the discretion of the investment decision lies with the investor, hence there is no obligation to invest in a particular startup from IPV’s side. However, the activity of the members throughout the year is used to determine the movements in the membership slabs (Bronze, Silver, Gold) as all members start with Bronze membership.

One can start their investment journey with INR 1 lakh, (max 1 deals via direct captable, max 3 deals via AIF) per investor per startup with no maximum limit. However, there is no minimum limit of investment that an investor has to make during a particular year.

What is a Demat account? Is it mandatory to have a Demat account to start investing?

Dematerialization, commonly referred to as “Demat,” is the process of converting physical securities or investments into electronic form. Yes, it is mandatory by SEBI circular SEBI/HO/AFD/PoD1/CIR/2023/96 dated 21st June 2023. It is mandatory for all types of Direct and AIF Contributors: Residents, NRI’s, Overseas etc

Will there be any impact on taxation after Dematerialization of Units?

Tax will be calculated in the same manner as we were calculating in the physical units. Hence Dematerialization has no Impact on the calculation of taxation.

What is Client Master List ?

Client master list (CML) Report. It contains your Demat account details – Name as per Demat Account, DP ID, Client ID, Nominee details, Bank details linked to Demat Account .

What are my responsibilities as an IPV member?

As a responsible IPV member, you are expected to:

- Exercise judgement and maintain professionalism in all communications.

- Raise a query on the app for any question you may have; IPV shall respond to queries only if raised on the app. Considering the number of channels, queries raised to IPV on discussion forum, this will ensure timely redressal and effective monitoring.

- You can raise any queries, you may have on the business or to the founder on the respective Startup Investor Partnership (SIP) calls held periodically, where the founder provides updates on business performance.

- Volunteer to participate through the LetsGrow program for a particular startup should you wish to deeply engage with the startup and help them grow.

- Provide all necessary information and decision to ensure investment and exit procedures are completed on time and does not hamper the collective interest of the group.

What operating rhythm should one expect? What activities would be covered in the initiative?

IPV has started what is called as “Startup Saturdays” and “Wonder Wednesdays” wherein we have a founders’ call every Saturday from 11 am to 12 pm and on Wednesday 6:30 to 7:30pm, wherein the founding team of curated startups pitch their business idea to the investors.

If the startups gather enough interest, we also have a follow up call known as investors’ call, typically from 10 am to 10:45 am every Saturday and 6:30 to 7:30 on Wednesdays, where the IPV core team supported by IPV analysts and SMEs conduct detailed due diligence and its findings are presented in the form of business summary, scorecard and valuation report.

This frequency can be increased as required. The topics covered in these calls are:

- Founders’ call: Presentations by startup founders. (a business model pitch followed by Q&A session). A feedback form is shared on this, through which you can share your views on the business pitch.

- Investors’ call: Due diligence findings along with investment and valuation report is presented by IPV team. You can provide your investment interest through the commitment for post the investor call.

- AMA Sessions: Ask me anything sessions with IPV founders. Can be found in the agenda section of the App.

Masterclasses: Learning sessions with experts on deep topics on angel investing in startups.

How do I get access to startup pitches and documents?

Startup pitch documents, IPV due diligence documents and Startup Saturday webinar recordings are available to IPV investor members through the IPV app as well as on request through the IPV Whatsapp BOT (+91 93190 85247).

What will be the proof of investment that I'll make?

If you are a direct investor, you’ll get a copy of your share certificate over your email as well as this will be uploaded on IPV App (you can view it under portfolio section).

Because of issues faced in the past by investors & IPV, for e.g. share certificates being lost in transit, calling back of share certificate for rectifications, delay in exits, misplaced/lost share certificates etc. the physical share certificates we keep at IPV’s possession (taking all necessary precautions). If the share certificate is misplaced the investor has to file an FIR. To avoid hassles for the investor we have provided a robust fireproof steel locker to store these certificates.

As a result, our default process is keeping the share certificates with IPV, but in case you wish to receive the hard copies of the same for any startup investment you make, please feel free to reach out to your relationship managers 1:1.If you invest via AIF, you will receive a pdf of your monthly unit statement with updated list of investments on email. Also your units allocated will be dematerialised in your demat account.

How frequently does IPV share start-up MIS to monitor performance?

IPV does not charge a management fee and therefore is not responsible for actively tracking the performance of investments. However, to facilitate performance monitoring, IPV organizes Startup Investor Partnership (SIP) calls on a periodic basis. These calls provide an opportunity for members to engage directly with the founders and gather updates on the start-up’s progress.

In addition, interested members can participate in the LetsGrow program and volunteer to support the start-up. Through this program, members can receive regular updates directly from the founders, allowing them to stay informed about the performance and developments of the invested start-ups.

Who is responsible to monitor compliance, adherence to business plan and ensure annual reports, AGM notices are received and shared with members?

Whilst periodic compliance and adherence to business plan are part of the SIP updates, which is regularly presented by founders to members, all notices are shared with persons identified and nominated in the Share Subscription and Share Holders Agreements. Furthermore, annual reports are publicly available documents, filed with the MCA, accessible to all for a fee prescribed by the Government.

Does IPV share AGM / EGM notices with all members?

As investor representatives, through the General Power of Attorney signed by members, the nominee receives all notices. Members who have invested directly on the cap table would also receive the notices. For AIF Investors, the fund manager acts as the representative and receives all notices and documents, the contributors get annual updates on individual asset performance through the unit statement and annual report of the fund. Should the contributors be interested in getting the notices and documents of the startup, IPV can facilitate the same for a nominal fee. Please get in touch with your RMs to raise the request.

Also, IPV is in the process of setting up mailing lists to disseminate startup wise information with its investors, as received from founders, on a best effort basis. The process will be notified once ready.

Does IPV attend all AGM / EGM and update members of decisions?

A LetsGrow team is nominated to attend the meetings. LetsGrow investor mentors, who have volunteered to help the startup through the LetsGrow program, may also be nominated to attend these meetings. Since IPV does not charge any management fee, IPV is not responsible to track progress or activities of the investments.

Does IPV monitor the deals and ensure investments don’t fail?

No, IPV does not actively monitor the deals and ensure investments don’t fail. However, IPV has maintained a failure rate below 10%, which is significantly lower than the average failure rate of startups reported in the market.

The collective responsibility to monitor investments and provide inputs to the founders lies with all the invested members and shareholders. This monitoring and collaboration can be done through Startup Investor Partnership (SIP) calls or the LetsGrow program. IPV does not charge a management fee and is not accountable for tracking the progress of investments.

To facilitate member tracking of performance, IPV organizes SIP calls, which allow members to engage with founders on a periodic basis. These calls provide an opportunity to stay updated on the startup’s progress.

IPV believes in investing not only monetary resources but also experience and connections to help startups grow. They have witnessed the positive impact of investor engagement in companies such as Otipy, Fitso, MilkBasket, Toch, and others, where greater investor involvement has contributed to faster and higher growth.

To reduce failure rates, IPV encourages interested members to participate more deeply with the founders through the LetsGrow program. This program allows members to provide assistance on specific topics identified or requested by the business. For more details, members can refer to the LetsGrow FAQs.

Does IPV sit on the board of all companies?

No, IPV does not sit on the board of all companies. In most cases, IPV has the right to exercise a board seat or board observer seat but chooses to do so only in a few instances. This may occur when specifically requested by the company or in cases of emergency intervention. Additionally, IPV members may also be invited to sit on the board as representatives.

Is IPV responsible to ensure all start-ups perform?

No, IPV is not responsible for ensuring the performance of all start-ups. It’s important to note that most startups fail, and investments are individual decisions made by investors on a deal-by-deal basis. Unlike a venture capital fund, IPV does not have the ability to guarantee performance across all start-ups. This is why IPV does not charge management fees, as it does not assume responsibility for monitoring performance.

To maintain consistency and quality, IPV designates a few members as lead members for deals. However, all members are encouraged to provide feedback during due diligence, identify themselves as subject matter experts (SMEs) to offer deeper insights and guidance, co-lead deals, and ask questions before the investment commitment call. The lead members and analysts are available to address any queries, making due diligence a collective process.

It’s crucial to acknowledge that all investments are subject to market risks, particularly in angel investing, which is characterized by high risk and potential high rewards.

Furthermore, the responsibility of running the business rests with the founders. As shareholders, IPV can provide suggestions and guidance to facilitate the growth of start-ups. The Startup Investor Partnership (SIP) and LetsGrow programs are available to enable investors to actively contribute and offer guidance to start-ups.

Will I receive updates if I have not paid my IPV membership fee?

Yes, you will receive updates on your portfolio only on the respective SIP calls. Whilst you will receive the SIP call invites and can participate in the same, letsgrow access, historical data access (WhatsApp chats and documents) would be restricted. The updates will be shared live on SIP calls. Furthermore, there would be a higher fee charged on exit from the invested startups.

With “IPV Recharge”, where a member who wishes not to renew the membership going forward but has invested in startups would for a nominal fee, get all updates through App and BOT related to your investments and other announcements available to any IPV Paid Member. However you do not get to invest in any fresh start ups but will have access to all masterclasses and updates on the platform.

When is a Startup’s Quarterly update or Performance Review call organized?

Startup Investor Partnership (SIP) calls are scheduled on a periodic basis to faciliate investors and founders to interact, present updates, seek clarity on growth and progress of business plans, provide insights into market and competition, collaborate to achieve value creation projects and most importantly guide the founder to achieve his business plan ambitions. We have observed that more the participation from investors on these calls, the better the growth of the startup.

Furthermore, these calls are not questioning sessions, but collaboration sessions, where investors are expected to guide the founders and nudge them in the right direction.

These calls are typically help on a quarterly basis for each startup, with the time and schedule confirmed in advance and calendars blocked. However, if an exit opportunity has been presented to investors, the periodicity of SIP calls shifts to once in six months and where more than one exit opportunity has been presented, the periodicity shifts to once in twelve months. This is considering the size of the startup, growth achieved, support investors are able to provide and overall holding in the startup.

The deck presented on SIP calls is shared, on a best effort basis, prior to the call, uploaded on the app and shared in advance with LetsGrow mentors. The calls are moderated by LetsGrow Lead Mentors or IPV LetsGrow SPOCs.

How does IPV help the start-up grow?

IPV supports the growth of start-ups through various initiatives. In addition to the SIP (Startup Investor Partnership) and LetsGrow programs, IPV organizes regular VC Connect events. These events provide opportunities for founders to present their propositions to the broader VC community, fostering connections and potential investment opportunities.

Furthermore, IPV showcases a curated list of start-ups to large corporates. This exposure can lead to potential partnerships, investments, or even acquisitions, as corporates may have an interest in collaborating with the portfolio companies for various reasons.

These efforts by IPV aim to facilitate the growth and development of start-ups by connecting them with relevant stakeholders, including venture capitalists and corporates, who can contribute to their success.

Does IPV help start-ups in raising subsequent rounds of funds?

Yes, IPV helps start-ups raise subsequent rounds of funds by providing insights, connections, and guidance. IPV leverages its extensive investment banker network and the VC ecosystem to offer valuable advice to founders considering additional funding. They also connect founders with various sources of funds, including venture capitalists, bankers, and other potential investors, to support their business plans and fundraising efforts.

Does IPV provide Sectoral Views?

Yes, IPV provides sectoral views through its members, who are subject matter experts (SMEs), CXOs, and experienced investors. These members periodically offer industry insights and share relevant literature for the benefit of the platform and founders. IPV Partners also engage in discussions with other VCs and industry veterans to stay informed about market dynamics and trends. These insights are valuable when evaluating start-ups and negotiating valuations.

However, it’s important to note that IPV does not recommend or insist on investing in a particular sector. Investment decisions are solely made by the individual members based on the facts presented by the deal teams.

Does IPV team ensure all investments give good returns?

No, the IPV team does not guarantee or ensure that all investments will provide good returns. While the team assists members with administrative coordination, such as monitoring commitments, coordinating term sheets, obtaining approvals on Shareholders’ Agreements (SHA), and arranging periodic monitoring calls, the actual returns on investments are influenced by various factors. These factors include market conditions, deal structure, macroeconomics, and, most importantly, the founder’s ability to negotiate valuations for future rounds of investment.

How does IPV create exits and ensure members have regular cash flows?

IPV actively seeks exit opportunities, but actual exits depend on market conditions and deal structure, impacting timing and returns. IPV coordinates with founders to facilitate exits at regular intervals, but there is no guarantee due to external factors. Members are solely responsible for the decision to exit and providing necessary documentation. Delays in complying with exit requirements can affect the process for all investors involved. Regular cash flows and successful exits are influenced by external factors beyond IPV’s control.

Will IPV advise when and whether to exit?

No, IPV will not advise when or whether to exit. The decision to exit is solely up to the members. IPV will present the current facts, including the performance of the investment, market conditions, macroeconomic factors, and market dynamics for members to consider in their decision-making process.

In the event of an opportunity for a full exit from a startup, the decision will be made based on the majority view of IPV investors, determined by the value of their investments.

Would I be forced to exit the investment if IPV exits?

No, you would not be forced to exit your investment if IPV chooses to exit. IPV does not prevent investors from selling their holdings to any buyer of their choice. Similarly, IPV also has the right to independently exercise its decision to exit and sell its holdings to any buyer identified by IPV at any point.

In the event of an opportunity for a full exit from a startup, the decision will be made based on the majority view of IPV investors, determined by the value of their investments.

How does IPV manage communication between investors and startups?

IPV provides a platform through the app and WhatsApp groups for smooth coordination between investors for either investment or exit to ensure there are no delays. Whilst IPV sets up these channels of communication, members are free to collaborate on these forums. IPV is not responsible for delays in decisions by members for investment or exit and any opportunity missed by few members on events agreed and subscribed to by a collective majority.

The platform available to members for communication are:

- Investor queries to IPV: Raise a query section on the IPV App, Ask me Anything Zoom Sessions with IPV founders

- IPV communication to Investors: Admin only deal wise WhatsApp groups, BOT, App posting, Emails, RM communications,

- Investor interaction with founders: Start-up Investor Partnership Calls, Deal wise LetsGrow WhatsApp groups

- Investor, IPV, Start-up collaboration: Deal wise LetsGrow WhatsApp groups

- Investor to Investor: Not monitored or managed by IPV. Points related to specific can be discussed on Start-up Investor Partnership Calls.

IPV has its own proprietary App, which is a platform for investors to engage in discussions about the Start-up ecosystem. The app has different sections, main ones are as elaborated below.

Main features with specific purpose:

- Start-ups: This section provides information about start-ups being evaluated for investments, investments in process and IPV portfolio start-ups.

- Agenda: This section provides call schedules for Founder’s calls, Investor calls, SIP calls, AMA sessions and Masterclasses. Users can register via the App, can seek information or post messages specific to the session before or while the session is on. Feedback form links, commitment forms links are released in this section.

- Portfolio: This section provides you information of the deals you have invested in and is visible only to you. Invested, Committed and exited deal information, all three can be seen. Also provides you access to your share certificates.

- Raise a query: This section is for an investor to seek customer support, log an issue or any escalation. It can be used for seeking information as well.

- Refer a member: This section enables members to conveniently refer their family, friends or acquaintances to IPV.

- Discussion Forum: The discussion forum is an open forum for investors to initiate and engage on topics around the start-up ecosystem.

As larger, diverse group of investors join the forum, we are starting to see posts that are self-promoting and/or irrelevant to the platform. Hence we are providing guidelines for this forum.

How to Report Spam on the App?

As a user you can participate and support IPV in keeping the discussion forum clean by reporting spams. Any post not in line with the policy may be reported:

- As a user one can report any post as spam. The IPV team will review and take relevant actions, delete the post if not relevant to the forum.

- If any specific user’s posts are marked as spam on more than 3 different occasions, IPV reserves the right to deactivate the user’s access.

Communication Guidelines

IPV App is a platform created to keep abreast of the start-up ecosystem, for investors to engage in conversations on innovation, new technology, or start-up ecosystem updates.

To ensure sanctity of the forum and focused discussions, users are advised to be aware and engage in discussions responsibly. There are different categories in which we ask user to kindly refrain from posting, and engaging is such conversations posted by others is at the users own risk.

- Any posts related to startups and its ecosystem is encouraged on the IPV discussion forum. Such as

- Budget impact, government policies impacting Start-ups.

- Sector specific information and industry trends etc.

- Looking for co-founders, CTOs

- Seeking advice on fund raising methods

- Any other discussions on start-up ecosystem

- B) Following category of posts are disallowed on the IPV App.

- Speculation: Posts which are not backed by substantiated data or verified source of truth, is treated as speculation. This includes but not restricted to personal opinions on religious views, politics, unsubstantiated rumours on start-ups/businesses.

- Start-ups not backed by IPV:

- Start-ups/Founders that are seeking funding, to kindly follow protocol and apply on ipventures.in/contact-us/startup/

- Soliciting funds for businesses- that are not evaluated by IPV. IPV is not responsible for people reaching out and engaging in raising funds that are not evaluated by IPV. While posts will be deleted, users engaging directly may do so at their own risk.

- Authenticity of the claims of it being a unicorn idea and unsubstantiated claims of returns, is not backed by IPV.

- Promise of equity for expertise by users has no link to IPV and holds no responsibility towards these claims.

- Business promotions: IPV App is for sharing of knowledge, a microlearning platform and for networking. Business promotions and ad campaigns are not allowed. Including consultancy services.

- Code of Conduct: Users to understand that this is a professional network, with an opportunity to learn from one another. Indulging in unparliamentary language, creating unrest amongst the investors, misleading the forum, getting into conflicts with fellow investors should be avoided. IPV reserves the right to withdraw access to the App and discontinue with membership.

I’m seeking funds for my start-up, would like to connect with investors directly on IPV App?

At IPV, we have stringent selection criteria to invest in great founders, running great businesses, available at reasonable valuations. The Selection Panel screens 100s of start-ups each week and picks out the one with highest conviction. If you would like to raise funds from IPV investors, we invite you to apply through https://ipventures.in/contact/#startup-contact. IPV is not responsible for people reaching out and engaging in raising funds that are not evaluated by IPV.

Similarly, IPV holds no responsibility on start-ups claiming their ideas to be a Unicorn and promises of unsubstantiated returns, promises of equity for expertise or making good of these promises.

I’m a qualified professional and believe I can add value to the start-up industry, how can I provide the expertise?

It would give us great pleasure to include you in supporting the start-ups growth. There are three ways in which you can sign up for this.

- You can fill up the feedback form for the startup of your interest and express that you have the subject matter expertise and would like to contribute. Our team will reach out to you.

- You can join the Lets Grow group of the start-up you have invested in and support in its growth.

- You can sign up on Founder’s Genie and get access to a larger Founder base.

This is on voluntary basis and there are no commercial considerations in this. In case the founder finds it feasible

Can I share my CV on the IPV app?

Although IPV App is built for networking, it is primarily to learn and understand the Startup ecosystem. Posting CVs on the discussion forum takes away the focus. You can, however, post it on http://onelink.to/foundersgenie which is visible to a wider network of startups looking to hire candidates.

How can I reach IPV team to get my queries resolved?

IPV’s customer service via its raise a query feature on the IPV App https://ipventures.in/app/raiseaquery which will ensure quickest turnaround on your issues. Be it with respect to your documents, information on startups or tech issues. We target a TAT of 48 hours to help serve you in an efficient manner, however, there could be delays because of unavoidable circumstances. Raise a query on the app for any question you may have; IPV shall respond to the queries only if raised on the app. Considering the number of channels, queries raised to IPV on discussion forum cannot be effectively monitored and addressed in time.

For information on invested startups, raise any queries you may have on the business or to the founder on the respective Startup Investor Partnership (SIP) calls help periodically, where the founder provides updates on business performance.

Can I talk about the invested startups on the app?

As an investor we have certain responsibilities towards the startups we have invested in. Topmost of those pertains to confidentiality of the startup’s information. The startup’s performance is privy only to its investors and not to public at large.

IPV provides a platform for easy communication between various stakeholder, it is imperative that investors exercise judgement and maintain professionalism in all communications. Volunteer to participate through the LetsGrow program for a particular startup should you wish to deeply engage with the startup and help them grow.

Why does IPV not allow talking about sports or religion?

IPV platform is a progressive forward-thinking network of investors focused on startups and its growth. Adding discussions on politics and religion does not serve the purpose of this platform. Such sentiments can be very strong in Indian context, which can lead to unnecessary conflicts. Hence any posts on politics and religion is restricted on the IPV app or investor groups. IPV holds the right to suspend or ban any user account, for severe, ongoing or repeat violations of the platform’s policies and/or code of conduct.

What is Gujarat International Finance Tec-City (GIFT City)?

GIFT City is being developed as a global financial and IT Services hub, a first of its kind in India, designed to be at par or above with globally benchmarked financial centres. GIFT’s Master Plan facilitates Multi Services Special Economic Zone (SEZ) with International Financial Services Centre (IFSC) status, Domestic Finance Centre and the associated social infrastructure. “GIFT SEZ Limited” has been formed by Gujarat International Finance Tec-City Company Limited (GIFTCL) for the development of Multi Services SEZ at Gandhinagar with the prime focus being the development of IFSC and allied activities in SEZ.

What is an IFSC?

IFSC Stands for International Financial Services Centre. An IFSC caters to the customers outside the jurisdiction of domestic economy. Such centres deal with the flow of finance, financial products, and services across the borders. IFSC as envisaged under the Indian context “is a jurisdiction that provides financial services to non-residents and residents (Institutions), in foreign currency other than Indian Rupee (INR)” IFSC is set up to undertake financial services transactions that are currently carried on outside India by overseas financial institutions and overseas branches/ subsidiaries of Indian financial institutions.

What is IPV International Fund?

The IPV International Fund is a GIFT City-registered, Category-I Angel Fund established within the IFSC to facilitate foreign investments. This fund is specifically created to enable IPV to undertake foreign investments, approval of which are difficult to obtain via FirstPort Capital due to time taken by SEBI to approve overseas investment application. With the launch of GIFT City, NRIs can now seamlessly channel their investments into India, benefiting from relaxed compliance requirements relaxation in holding an Indian PAN or demat account, allowing for more streamlined fund transfers. Additionally, from fund perspective there won’t be any requirement of INVI filings in pursuance to receipt of funds through NRE/Foreign accounts therefore making investments and redemption more hassle free in terms of regulatory f ilings.

What is FME?

FME stands for Fund Management Entity. The FME is registered with the Authority under a category specified in Regulation 3(4) of the IFSCA (Fund Management) Regulations, 2022 to conduct fund management activities within an International Financial Services Centre (IFSC). This registration ensures direct oversight of the fund manager, aligning with global best practices. IPV International Ventures LLP is the FME of IPV International fund.

Difference between Non-Resident in India (NRI) and Foreign National?

Any individual who holds citizenship of country other than India and is not resident in India is considered as outright Foreigner/ Foreign National whereas an individual who holds Indian citizenship but residing outside India will be considered as NRI.

Can I take a Trial Membership to test and experience IPV International Fund?

Yes, a member can take 1 month trial membership on IPV International Fund. For more information, investor to connect with their respective Relationship Manager.

What will be the annual membership fee that will be charged from investors for becoming member of IPV International Fund?

The annual membership fee will be $700 (INR 59,017).*1$= INR 84.31 considered. For more information, please reach out to your RM (ISM)

What is the advantage for Indian Residents to invest via IPV International Fund Vs investing via FirstPort Capital?

Indian Residents will now be able to invest easily in foreign startups through IPV International Fund whereas in FirstPort Capital, obtaining approval of foreign investments is difficult due to time taken by SEBI to approve overseas investment application.

What privileges / services should I expect as a paid member of IPV International Fund?

IPV provides the following benefits to its members:

- IPV Bot Lite

- IPV’s APP access

- Access to Foreign startups and pitches

- Access to investing in a wide array of startups. We’re sector agnostic.

- Access to Due Diligence and evaluation reports

- Access to MBA Initiative

- Designated region wise Investor Success Manager

- Networking Events: Currently we have our offline presence in SEA and GCC regions.

- Online Masterclasses

- Members rewards program: Members can earn points for investing, referring new members, helping startups, providing mentorship time etc. The points can also be redeemed to pay for the annual subscription charges. Privileges for AIM+ members are over and above these privileges. Please contact your RM for further information.

At the time of onboarding, what type of paperwork will be required from Investors?

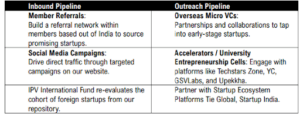

IPV strategy to attract foreign startups is tabulated below:

Do we have a separate app for IPV International Fund?

We are pleased to inform you that our investors would be able to continue with IPV App itself to access IPV International Fund, as we have added the relevant functionalities for the same.

How does IPV plan to source / attract the foreign startups which ensures quality and quantity of startups?

IPV strategy to attract foreign startups is tabulated below:

Are there any foreign startup’s that IPV has already been working with?

We have received certain inbound interests from fintech and consumer tech sectors but as of now nothing is definitive since it is at preliminary stage of diligence. Rest, the investment approach is going to remain sector agnostic.

Will investor have the option to choose startups for investments?

Since IPV International Fund is a CAT-1 fund, investments will be made after consent is received via commitment form

How would an investor exit from IPV International Fund in future and what is the exit procedure?

Exit mechanism would typically be the same as our FirstPort Capital, therefore upon exit from a portfolio entity distribution proceeds will be distributed pro-rata based on the contribution after deduction of any fees charged by IPV International Fund basis the commercials agreed in the Contribution Agreement

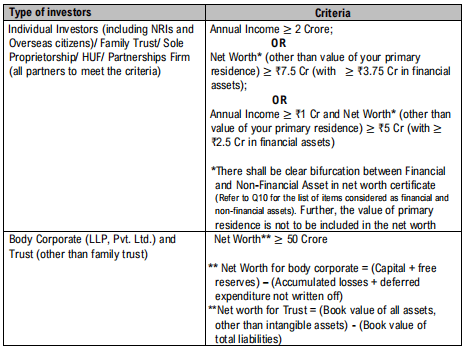

Who can be considered an Accredited Investor (‘AI’) under SEBI regulations?

As per Sub-regulation 2(ab) of the SEBI (AIF) Regulations, 2012 (as amended on September 8, 2025), an Accredited Investor (AI) is any person who has been granted a certificate of accreditation by an accreditation agency, after meeting the below eligibility criteria:

Angel investor means an accredited investor, or key management personnel of a fund or its manager, who invests in the fund.

Note: If you are a joint investor:

- If joint holders are Parent(s) and Children – At least one should meet the criteria.

- If joint holder is Spouse – Combined Income/Net Worth should meet the criteria.

Note: Net Worth Certificate is to be issued by a Chartered Accountant in practice in India based on their supporting documents.

As per the guidelines, which investors are mandated to obtain Accreditation?

All investors in AIFs must obtain an accreditation certificate by September 7, 2026 to continue investing through Angel Funds.

Note – However, existing investors (whether AI or non-AI) of the Angel Fund can continue to hold their investments already made. Their investments will remain intact, and they will be able to take exit as and when the exit opportunity arises.

What is the validity of Accreditation certification?

The Accreditation Certificate can be issued for a validity period of either 2 years or 3 years, depending on the applicant’s financial eligibility history. The investor may choose the duration when applying for the certificate based on which eligibility period they fulfill.

Who is required to take accreditation certification in case of joint investors?

A single accreditation certificate will be issued in name of the joint investors. It will contain name of both the investors.

For eg. – If Mr. X (Primary Holder) and Mr. Y (Secondary Holder) wish to obtain an accreditation certificate, their eligibility as joint holders will be evaluated. The accreditation certificate will be issued jointly in the names of both investors, clearly indicating Mr. X and Mr. Y.

Can a joint Accreditation Certificate be used by one joint holder to make investments solely in their name, or is an individual certificate required?

If a certificate is issued to joint investors, it cannot be used by just one individual from the joint holders to make investments in their sole name. For single-name investments, an independent Accreditation Certificate in the individual’s name is required, even if the individual also meets the eligibility criteria on their own .

Who grants the accreditation certificate to investors?

SEBI has also authorized NDML and CVL and all KRAs to act as accreditation agencies. NDML and CVL are currently issuing accreditation certificates. While the KRAs are yet to begin operations, they are expected to become functional in the coming months.

What does annual income mean in relation to the eligibility criteria?

The annual income here refers to the gross total income earned from all sources before applying any deductions under the Income-tax Act, 1961. Further, it also includes any exempt income (provided it is reported in the return of income) which is not taxable under the Income-tax Act, 1961.

Note – For foreign investors filing income tax returns in their home country, the annual income eligibility must be assessed in Indian rupee equivalent value at the prevailing exchange rate.

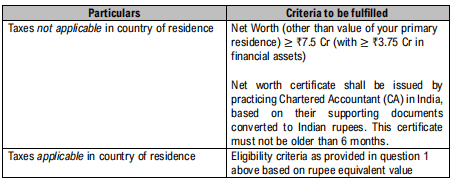

What documents would be required from the foreign investors who don’t file income tax return in their resident country?

If an investor meets the net worth criteria, what should be the format of the net worth certificate? Also, what assets are included in financial assets and non-financial assets?

SEBI has not prescribed any format of the net worth certificate. However, it is important to ensure a clear bifurcation between Financial and Non-Financial Assets.

In Illustrative view, financial assets and non-financial assets may include the following:

Financial Assets (broadly includes):

- Equity shares (listed/unlisted)

- Bonds, debentures, govt securities

- Mutual fund units

- Cash, Bank deposits including fixed deposits

- Accounts Receivable

- Loans and Advances given

- Units of AIFs, REITs, InvITs (Market Value, if available)

- Capital introduced in entities other than company (If valuation provided to the CA)

Non-Financial Assets (broadly includes):

- Fair Market Value of Real estate (land/buildings) excluding primary residence

- Vehicles, jewellery and other similar assets

Step by step process to obtain the accreditation certificate.

The process flow for applying for accreditation is as follows:

- Check which eligibility criteria for accreditation do investor fulfill.

- Gather and prepare all required documents.

- Choose an authorized agency (e.g. NDML/CVL/KRAs).

- Complete the online application and upload documents.

- Pay the application fee and submit the form.

- The agency verifies documents as per selected criteria.

- If approved, the certificate is issued within a week.

- If rejected, reapply with fresh fees (no refund for earlier payment).

Do we need to get the certificate renewed after the expiry of validity of the accreditation certificate i.e. 2/3 years?

Yes, the certificate is to be reapplied after the completion of the validity of the certificate .