A startup is an early-stage business established by entrepreneurs that look for novel solutions to existing problems or to offer consumers something new.

Startups constitute a significant part of any modern economy, and their founders represent some of the most innovative and creative minds in society. Establishing startups and getting them off the ground is a long process involving several steps. From idea formulation to plan rollout, the one crucial aspect is funding. Startups may raise funding via different channels; however, valuation plays a vital role in determining the future of the business.

Startup valuation is the process of determining the value of the company at a particular stage, accounting for several influencing factors and comparisons. These factors can be linked to their past-current performance, traction, partnerships, future roadmap etc. The valuation of a startup keeps on changing as the startup performs better and grows further and raises more funds.

Like any business, valuations are crucial to determine the future of any startup. However, the process of business valuation is rarely a straightforward one. Several factors such as duration in business, stability of earnings and other industry specifics can influence the valuation. In this article, we will be going over the basics of how to value a startup.

The difference between startup valuation and mature business valuation

Business valuation is a crucial aspect that comes into play in several instances, such as during mergers, acquisitions, initial public offerings etc. Mature businesses have a customer base, financial statements (balance sheet, cash flow statement) and products or services based on which they can be valued. Revenue streams, clearly defined assets and other factors make it easier to value an existing business that has been around for a while. However, this drastically changes in the case of a startup as its valuation has a significant speculation component.

If we compare a startup valuation to a mature business valuation, the former is based on leading practices instead of previously set standards. Unlike mature businesses, startups have no stable revenue streams or operational experience, and hence startup valuation involves a high-risk factor that requires a different approach. It is natural for business owners to expect higher valuations, whereas investors like a more realistic approach that will ensure a higher return on investment.

Startup valuation also tends to be more dynamic because different techniques and methods used by investors might yield different outcomes and are subject to a great deal of change. Considering how valuations are essential for startup owners to seek funding, they must be done with great caution to avoid anomalies.

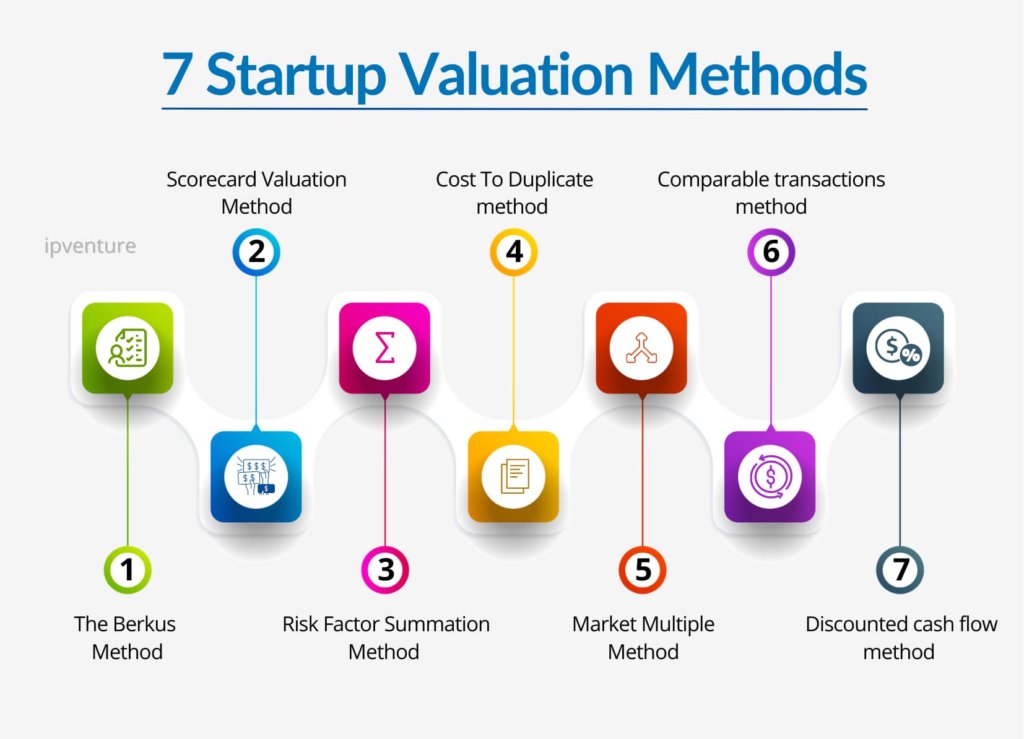

7 Most Popular Startup Valuation Methods

As already discussed, startup valuation facilitates future planning and is crucial. Considering that startups during the valuation stage are pre-revenue, the value is determined by analyzing a host of various internal and external factors, which is to be done with great precision. We will look at 7 of the most common ways of valuing startups.

1. The Berkus Method

Berkus method was established by angel investor Dave Berkus. He believes that investors must be able to envision breaking $20 million within five years, and his process works by relying upon five crucial aspects:

- Concept: The product concept must encompass some amount of creativity and innovation to stand out. The idea should have a fundamental value to an acceptable risk ratio.

- Prototype: Ensuring the prototype is in order and fully functional helps lay the groundwork for making the launch easier and mitigating the risk of initial failure.

- Quality management: Assuming the organization does not already have quality management, they will ensure that a future team will be set up. It is ultimately the quality of leadership that determines the course of a business. Good management is bound to have better planning and, hence, better risk mitigation.

- Connections: Business is all about intelligent networking as this can offer tremendous benefits to the launch, increasing chances of success. With strategic relationships and alliances in place, a business has a higher chance of succeeding.

- Launch plan: A launch plan ensures that a business has a better chance of getting off the ground and establishing existing goals.

2. Scorecard Valuation Method

Another popular valuation method is the scorecard valuation method which works based on the comparison. The scorecard method is ideal for determining the target’s average value and determining an acceptable average. Various factors such as market size, region, type of organization, quality of management, and the industry sector are considered. The scorecard method has proven to be comprehensive. This startup valuation method analyses the prospects of a startup on all fronts.

Using this method, startups are compared to those which are already funded.

- Firstly, you would be required to determine the average valuation of the pre-revenue startups.

- From there on, weighted percentages and market data are used to compare the two businesses. This method helps investors with finding the most accurate amount to be invested. It also helps provide some insight into the future course of the company.

3. Risk Factor Summation Method

The risk factor summation method utilizes a base value of a comparable startup for the company’s valuation. To go about this method, firstly, you will have to determine the average valuation of your company. Secondly, you will have to look into the various risk factors impacting your startup.

The base value is adjusted to 12 risk factors which are listed below:

- Risk of the Management

- Stage of the business

- Political risk

- Supply chain or manufacturing risk

- Sales and marketing risk

- Capital raising risk

- Competition risk

- Risk of Technology

- Risk of Litigation

- International risk

- Risk of Reputation

- Exit value risk

The startup is compared to other such businesses on the basis of these 12 factors. This helps gauge whether your startup has a higher or a lower risk factor as opposed to others. Lower risks typically result in a higher valuation, while higher risks would lower the startup valuation.

4. Cost To Duplicate method

The cost to duplicate method works based on calculating the costs involved in how much it would cost to build another company just like it from the beginning. The rationale behind this form of valuation is that typically investors would not want to invest more than what it would take to duplicate the business. This startup valuation method requires a comprehensive evaluation of the assets of the startup to help determine the fair market value. This is one of the few approaches that does not necessarily look at the future of the startup.

5. Market Multiple Method

The market multiple method is based on the theory that similar assets sell at similar prices. It values the company against recent acquisitions of similar companies in the market. Similar to the cost to duplicate approach, it helps identify or estimate values that the investors are most likely to pay. This method of how startups are valued is most commonly used for those in their initial stages with very primary groundwork. Given the circumstances, in that case, this is the best method to obtain the most realistic outcomes.

6. Comparable transactions method

Although there are several valuation methods to choose from, most investors resort to the Comparable Transactions method. It is one of the most conventional methods proven to provide investors with realistic scenarios and values. Having been built on precedents is what makes it the most popular method. This method takes information such as how many other similar startups were acquired in recent years and uses that as a precedent to arrive at a valuation. The comparable transactions method is commonly utilized to compare and analyze two similar businesses.

7. Discounted cash flow method

This method of startup valuation relies on a future-based approach. It makes predictions relating to the company’s future growth and potential profit. This method is the most suited for recently launched startups and paints a clear picture of the future. Discounted Cash Flow method helps decipher an accurate investment return rate and therefore helps forecast the business’s potential. It further highlights the scope of growth, making it a precise startup valuation method.

Common Startup Valuation Mistakes

Mistakes are not uncommon in the evaluation stage. There are a few mistakes that most investors tend to make during this stage.

Thinking that valuations are linear

One of the most repeated mistakes is thinking of valuations as linear. The bottom line is that during the initial stages, there is no solid backing which indicates that there is a very high risk of value fluctuation. The valuation almost never remains permanent and is subject to constant changes that are based on market reception of business post-launch, socio-economic factors and so on. As startup valuations are dependent on several factors, it is subject to change based on these variables, and hence no valuation is final or permanent.

Being Too fixated on the numbers

Numbers and statistics help you understand whether or not a business has what it takes to get off the ground, however, this might not always be the case. Some of the most successful companies we see today had a great deal of risk during their initial stages. Where there is a higher risk, there is also the scope for a greater reward. Relying solely on hard figures might not be the smartest way to decide whether or not to invest in a startup. Look into the various influencing factors such as the credibility of the business. This is more likely to give you a better outlook.

Before moving to the valuation aspect of a startup, make sure to fully understand your needs and expectations as an investor and whether or not a startup meets that. Look into evaluations that take multiple factors into account to give you the most realistic figures. Only by considering the various perspectives and experimenting with different startup valuation methods. You will discover the best way to evaluate a business and make money.

Madhukar Bhardwaj

VP – BD & Investments, IPV

Madhukar Bhardwaj is a Business Management expert with more than 10+ years of expertise in E-commerce, Entrepreneurship, and Financial Markets Trading. He is the Vice President of Business Development & Investments in Inflection Point Ventures, a prominent Angel Investing Platform in India.