If you surf through LinkedIn profiles of entrepreneurs and investors today, you might often come across a term called “Angel Investor” in their introduction. Why? It’s simply because angel investment has become one of the most rewarding ways of diversifying your investment portfolio. Moreover, with the help of start-up investing platforms, angel investment has become more and more accessible for everyone.

Angel investment is when someone invests their own money in a start-up in exchange for a minority stake, but it is essential to understand that angel investment is about more than just money. Angel investors also bring their skills, support, knowledge, and network for the start-up along with the money. Thus, increasing the chances of a start-up’s success and consequent returns.

The article below will discuss several aspects of angel investment in detail, including how angel investment works and why you should become an angel investor.

Who are Angel Investors?

We have all grown up reading stories about angels rescuing and supporting protagonists of the story, right? In the case of start-ups, angel investors do the same. According to Business Insider, “Angel investors generally are high-net-worth individuals who provide funding to startups in exchange for convertible debt (bonds) or equity (shares) in the company.”

So an angel investor is an individual who invests in a promising early-stage start-up in exchange for company equity, but that’s not it! Angels are known for taking a hands-on approach. Along with money, angel investors also invest their time into the start-up and work in a close relationship with the entrepreneur to push the business forward. Angel investors are also known by other names like Private Investor, Seed Investor, or Angel Funder.

Most angel investors are experienced and well-informed entrepreneurs or investors searching for investment opportunities with a better rate of return than what is provided by traditional investment options. Moreover, cash-needing startups pleasantly welcome such investors because they provide more favourable terms than other, forms of funding like loans.

Today, individual investors have abundant opportunities to become angel investors. While high net worth individuals can directly invest by providing seed money to a start-up. Angel investing platforms like IPV has made it accessible to everyone with the desire to invest and be a part of the start-up ecosystem.

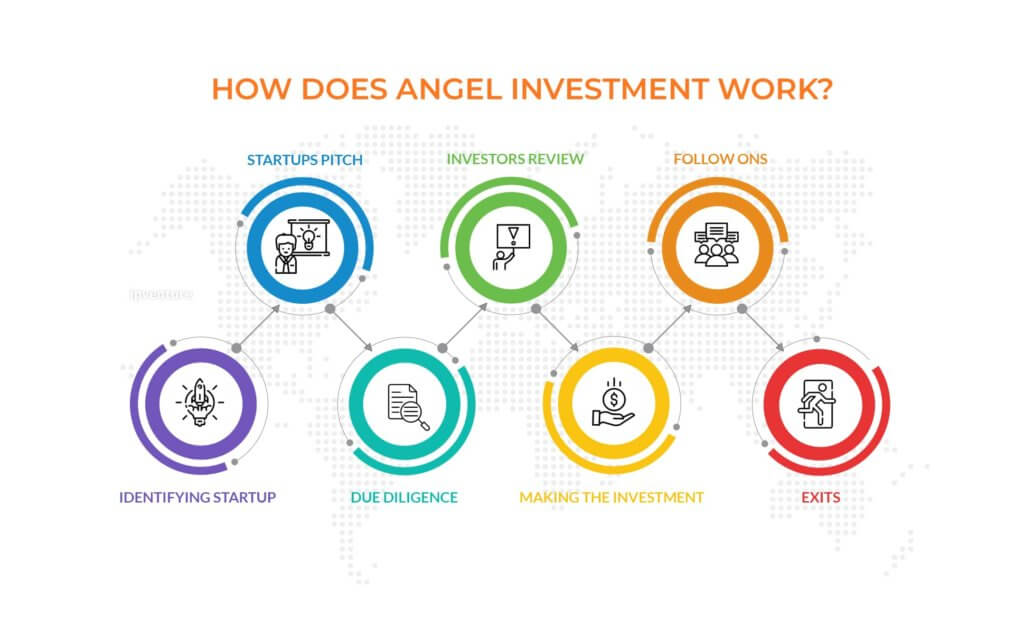

How does angel investment work?

In the year 2021 alone, India’s start-up ecosystem recorded around 442 angel funding deals which is a 15% year-on-year (y-o-y) increase from the previous year. Moreover, the profile of angel investors is also changing as more investors like salaried employees are entering the game that was only played by accredited investors till now. These are signs indicating that angel investment is working incredibly, but how does angel investment work exactly?

Angel Investment is about discovering promising startups at very early stages and funding them in exchange for equity. Most of the time, the startup doesn’t even generate revenue or doesn’t have a customer base at this phase. Therefore, the criteria for investing in a startup at this stage involves having a strong belief in the founders or the product and evaluating the business idea’s potential, strategy, product viability, etc.

There is no minimum or maximum range as far as the investment amount goes. The amount completely varies based on the startup’s potential and the financial risk capacity of the individual. However, the amount usually starts anywhere around INR 5 lakh and can go up to INR 5 crore per investor. Although, startup investing platforms like IPV are now offering a minimum investment of INR 2.5 lakh for investors to start their angel investing journey. In terms of when do angel investors get paid back? The exit event usually occurs between a 3-5 year period, but could be earlier as well.

Here are a few essential points to better understand the process of angel investment:

Identifying startups

Angel investors invest in startups with great potential and unique products. While choosing, investors must consider both the profitability scope of the startup and its non-financial indicators. The most successful angel–entrepreneur relationships have been achieved when angels have invested in companies that they have prior knowledge of or have been recommended to them by a friend or relative. Moreover, the people behind the startup must be considered as important as the product while deciding to invest.

Startups Pitch

After shortlisting, the startups are invited to pitch. A business pitch can be a formal presentation or an informal chat to give investors a general idea about the startup, its story, and its financial needs. In short, the entrepreneurs are invited to sell their ideas to investors.

Due Diligence

A robust due diligence process is done to evaluate startups and minimise the risk before finalizing the investment. This is one of the most important parts of the angel investing process. At this step, investors thoroughly investigate a company and its market to ensure a solid investment decision. The better you are at the Due Diligence process, the more likely you are going to invest in companies that yield great returns.

Investors Review

Investors make real decisions at this critical stage of the investment process. Pitch reviewing is a meticulous process involving critical analysis, asking follow-up questions, reviewing the business plan, defining exit strategy, and so on. Consulting with fellow investors is also crucial at this stage.

Making the Investment

Once the investors have finalized the startup, the angel or the angel group leader/manager connects with the startup founders to establish deal terms. At this stage, crucial details like valuation, deal flow, deal structure, board structure & reporting, due diligence, etc., are discussed. Once both the parties agree on a mutually acceptable set of terms, they are documented via a non-binding document called the TermSheet. Finally, once the investment amount and flow along with the terms have been settled, the deal is closed by signing definitive legal documents drafted by the lawyers.

Follow ons

Another important decision after making the initial investment is whether to follow it with further investments or not. A growing startup will always have an increasing demand for funds. But whether to follow-on, and how to follow-on, depends on a lot of factors including your goal and strategy from the very beginning.

Exits

Ultimately, the end goal of almost every angel investor is to cash out and make profits. For this to be possible, angel investors develop an exit strategy that usually spans over 3 to 5 years. This strategy is majorly about timing and picking the potential buyers/investors.

What is the difference between an angel investor and a venture capitalist?

| Basis | Angel Investor | Venture Capitalist |

| Definition | An angel investor is an individual who funds a promising early-stage start-up in exchange for company equity. | A venture capitalist (VC) is a private equity investor (usually part of a firm or company) who provides capital to budding companies with high growth potential in exchange for an equity stake. |

| Purpose | Other than the return on investment, Angel investors may also invest for different purposes like supporting a friend/relative, enhancing their professional portfolio, supporting a cause they believe in, etc. | The purpose of investing is to either buy out the company eventually or make a considerable return on investment. |

| Funding | Angel Investors are known to use their own funds for investment. | An expert manages and invests a sizable pool of funds collected from various investors. |

| Investment Stage | Angel Investors specialize in the pre-revenue early stages of business. | Venture Capitalists invest at a stage when the business has some level of establishment, revenue, and reliability. |

| Investment Size | Considerably less as compared to venture capitalists. | Comparatively large, since it’s a consolidated pool. |

| Screening and Review | The investor or the angel group leader/manager carries out the screening process best to their knowledge. | VCs have a team of experts at their disposal to carry out the screening. Sometimes, they also outsource the process to an outside firm. |

| Post Investment role | Active and personally involved, especially because most angels invest within their industry of expertise or the industry they are excited about. | Strategic role, only such as offering an extensive business network. |

What do angel investors get in return?

As discussed earlier, Angel Investors get paid back in company equity. The percentage of equity paid depends on the amount invested—the more significant the investment, the bigger the equity size. Usually, Startup founders look to dilute 10 to 30% of their company depending upon the need for funds. Moreover, Angel Investors invest in startups with an expectation of some return on investment. Although this return is subject to the startup’s success, it can be around 3x to 10x in 4 years. To earn this return, investors must also have one of these exit strategies –

– A large investor gives an exit to small investors post a company raises Pre Series A or Series A funding.

– A large company acquires the startup and pays investors in cash or equity in its company or a combination of the two.

– With BSE launching a Startup IPO portal, many startups are going public and taking the IPO route.

– Although unusual, the investors may sell their shares to other parties.

Read this detailed article to know more about “How Angel Investors make money in India?”

How to become an Angel Investor?

To become an angel investor, you need to have the funds and the desire to invest in a promising start-up. Most angel investors also have an extensive network of start-up founders and entrepreneurs within their industry of expertise. With the help of this network, angel investors can source deals to consider. Here are a few ways to start investing –

– One of the most common routes of angel investment is funding a start-up founded by friends or family.

– Another approach is to make a community of angel investors who can assess, review, and invest in a start-up together. Such groups are called Angel Groups.

– Syndication is another approach similar to angel groups where one angel investor leads the group. Syndicates usually comprise well-experienced and successful angel investors.

– The most convenient approach of Angel Investment is via joining a platform like https://ipventures.in/ that allows you to invest as little as INR 2.5 lakhs.

To become an angel investor, you have to choose one of these approaches and proceed with the steps of shortlisting, screening, reviewing, and closing the deal. However, before you invest, it is also crucial to be aware of these vital aspects of Angel Investment –

– While angel investments are highly rewarding, they also come with their share of risk. Angel Investment is considered risky especially because of its unproven nature. Investments are more based on projections and ideas, and less on facts. Having said that, the returns are also exponential at times. Hence, the bigger the risk, the greater are the returns. Moreover, this risk can be minimized through diversification.

– You should be aware of all the laws that regulate Angel Investments in India.

– You have to define your investment strategy based on the kind of investor you are. For example, if you have considerable funds to invest, you might consider diversifying your portfolio by investing in multiple startups and increasing your chances of earning a handsome ROI.

Why should one become an Angel Investor?

The world is evolving at a great pace and the investment industry is evolving with it. Today, technology has created an increasingly open-knowledge society with incredible investments opportunities in new-age companies and ideas. With wealth generation as the goal, it only makes sense to become an Angel Investor and invest in the ideas of the future. Moreover, becoming an Angel Investor also allows you to contribute to India’s Economy and job market. Here are a few more reasons why one should become an Angel Investor –

1. Angel Investors can make investments as small as INR 2.5 lakhs in a start-up. This also allows them to diversify and invest in start-ups in various sectors to mitigate the risk further.

2. Angel Investments have the potential for extremely high returns. They stand a chance of earning returns as high as 100x if the startup hits a home run.

3. Angel Investors can make investment decisions very quickly because they aren’t weighed down by institutional investors, shareholders, and board members. Instead, angels swiftly move through the approval and due diligence stages as individual investors or a group.

4. As discussed earlier in the article, angel investors get personally involved with the start-ups and help the business grow with their skills & experience. In addition, most angels also have experience and knowledge of the start-up’s industry, which they can use to provide valuable advice to the start-up. This can lead to more angel deals or paid roles as advisors.

5. Angel Investors get access to a very resourceful entrepreneurial community by working with startups and founders. They can tap into the whole support ecosystem and take advantage of the networking opportunities.

6. Through Angel Investing, many investors pursue their goals that align with the startup’s goals. Sometimes, investors also fund companies working for a cause they believe in, and angel investment becomes a way for them to give back to society.

Conclusion

Angel investing has seen substantial growth over the past few decades. As a result, it has become one of the primary funding sources for many startups. And more start-ups in the Indian business ecosystem has further led to the economy’s growth.

Madhukar Bhardwaj

VP – BD & Investments, IPV

Madhukar Bhardwaj is a Business Management expert with more than 10+ years of expertise in E-commerce, Entrepreneurship, and Financial Markets Trading. He is the Vice President of Business Development & Investments in Inflection Point Ventures, a prominent Angel Investing Platform in India.