With every passing day – startups, entrepreneurship, and startup investing are becoming a part of India’s dinner table conversations. By now, almost everyone knows what a startup is. For the uninitiated, a startup is a newly established business started by entrepreneurs with a unique idea, product, or service. As people understand startups better and read about their success in generating profits and impacting the world, they find startups to be great investing avenues. However, most do not know how to find or approach startups looking for funding. So let’s explore that in this article.

Why you should invest in Startups in India?

Earlier, investing in startups was an option available only to the wealthy who had a wide professional network. This is no longer the case because now an investor can easily invest in a startup using angel investment platforms. While startup investing is now more accessible than ever, it is essential to understand why you should invest in startups in India.

Early entry, huge rewards:

You stand a chance of earning 2x to 100x returns on your investment if you invest in the right startup at the right time. Prominent startups like Zomato, Paytm, Nykaa, Oyo are live examples that have given high returns to the investors. Moreover, the low requirement for overhead capital combined with high upside potential makes this investment even more lucrative. To further understand how investors reap multifold rewards on their money, you can check out this article.

Portfolio Diversification:

As a seasoned investor, most of your investments might be tied up in debt or publicly-listed equity instruments. Startups can give a refreshing makeover to your portfolio. Investors who invest in startups in India can spread their portfolio risk with little capital cost. Moreover, startups are also less prone to market fluctuations than shares and bonds. However, startup investing is a relatively less liquid asset class as opposed to normal debt or public-markets equity investing, and investors should be aware of this risk while investing in startups.

Transformation Potential:

Most startups originate serving a dire need or problem. Another reason to back entrepreneurs is if you believe that their product or service can benefit society and ease the struggles of people. In addition to generating returns, you also get the satisfaction of having helped others.

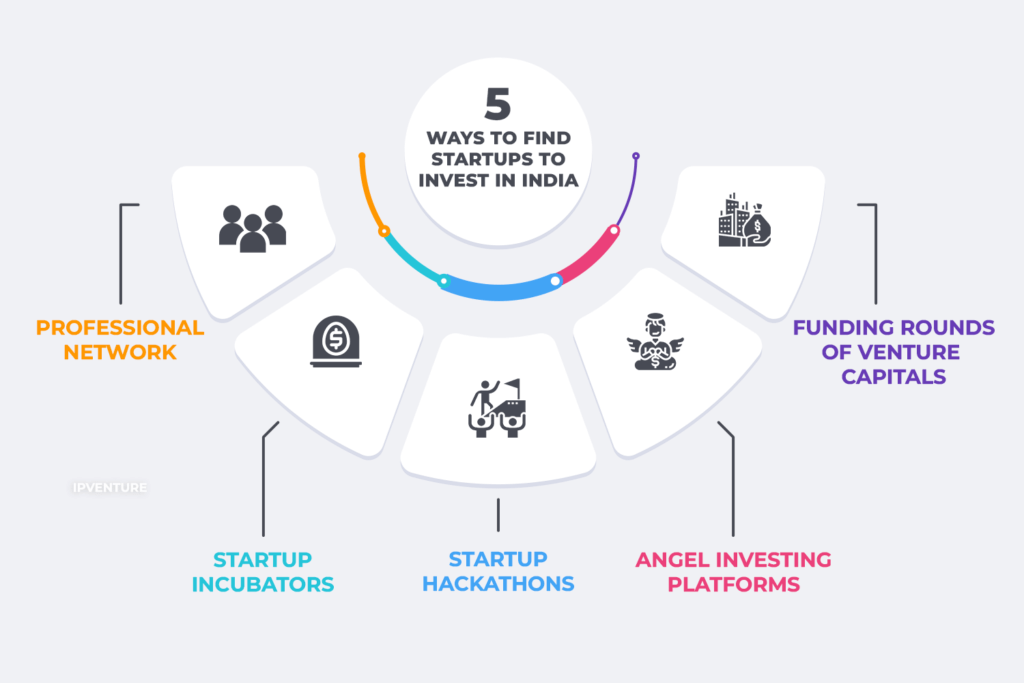

5 Ways to Find the right Startups to Invest In India

One of the most common ways of investing in startups is to become an angel investor. Angel investors are individuals who invest in promising startups in exchange for ownership in the business, usually in the form of equity. Now coming to the principal question – how an angel investor can find such promising startups? Let’s dig in!

Professional Network:

Your existing professional and social networks can be one of the best tools to find promising startups for investment. This way, you can get a headstart and invest in exciting ideas with huge potential. It also helps that you or someone you know can vouch for the business acumen and enthusiasm of the founders. One should also never underestimate the networking power of your immediate friends & relatives. In most cases, the first investors in any startup are people from the inner circle of friends and relatives.

But what if you do not have an existing professional network? It’s never too late to start building one! You can start with your workspace and utilize the potential of its current business network. Moreover, you can connect with professionals in your industry and expand your network using your common business interests. One of the best ways to meet such people is by attending events and seminars and building a connection with them.

Startup Incubators:

With startups coming out from every corner of the country, institutions and organisations have established incubators to guide startups and help them refine their idea and business model. Incubators help startups in their very early stage by providing relevant mentorships, advice, and guidance to develop their core business. You can find the country’s best incubators by asking around or doing comprehensive online research. Read up about the startups that are being incubated, their products or services and the stage at which the business presently stands. Based on your research, you can reach out to the founders themselves to find out about funding opportunities.

Angel Investing Platforms:

Angel Investing platforms are one of the smartest and the most effective ways to find startups to invest in. Such platforms bring a certain structure to the largely unorganised area of startup investing. These platforms make it easy for you to access information and save a considerable amount of time. A key differentiator between the various platforms is their startup onboarding process and the effort taken to analyze the business and vet the information provided. For example, thousands of investors trust Inflection Point Ventures because of their reliable identification of Winning Startups.

The process followed by Inflection Point Ventures –

- Initial shortlisting by a Selection Panel comprising 50+ CXOs, Business Leaders, and Partners from India’s top firms spread across industries and functional domain expertise.

- The most crucial Due Diligence process is done by a dedicated team of 25+ experienced professionals and Subject Matter Experts. With due diligence, the authenticity of the startups is ascertained and their business model and potential evaluated.

- Finally, a standardized evaluation process is followed to evaluate each startup on 150+ parameters across business quality, scalability, competition and more.

This exhaustive process ensures that investors can have maximum confidence in the success potential of that startup. Learn more about how IPV provides angel investors with all the information they need to make a smart decision.

Startup Hackathons:

Hackathons are idea-building marathons, where the most innovative and enterprising entrepreneurs participate in developing a product from scratch. As investors, you can attend or keep a watch on such Hackathons and select from the perfect pool of groundbreaking startups to invest in. Startup Hackathons is a good place to find good startups.

Funding rounds of Venture Capital:

If you cannot find startups to invest in, you can look for a seasoned venture capitalist instead. Venture Capitalists find startups with a high potential return on investment and provide the capital needed for the venture. This capital can be their own or of the other interested investors. You can either participate as an investor with a Venture Capitalist, or you can directly become an investor in the funding rounds if you have enough capital.

How much money is required to invest in a Startup?

Now that you know how to find startups to invest in, the next big question is about the amount of money required to make such an investment. According to a report by Orios Venture Partners in this article, India based startups raised approx $42 billion in 2021, up from $11.5 billion in the previous year. That’s a lot! But how much do you as an individual investor need to invest in startups in India? This number used to be very high a few years back. Back then, an investor would need at least INR 25 lakhs to invest in a startup; but things have changed with the introduction of investment platforms. Angel Investment platforms like IPV now allow you to invest in startups with a minimum investment of as little as INR 2.5 lakhs.

How to Invest in Startups?

Now that you have set apart a portion of your portfolio to invest in startups, have done your research and identified an early-stage business, all that is left is to actually make an investment. Here are a few of the common ways of investing in Startups –

Independent Angel Investors:

As discussed earlier, angels are individuals who invest moderate amounts of capital in startups. This can be done as a seed investment which is done very early in a company’s journey. Generally, seed investment is usually sourced from friends, family, and other acquaintances but can be provided by angel investors as well. Or you can also invest in a startup that has been running for a while and has raised capital previously. You can become an angel investor via various angel networks or platforms available in India. Learn more about how does Angel Investment work.

Venture Capital:

This is an investment usually run by private equity funds. You can reach out to such funds and get details about the startups they are currently funding. Venture Capital investment is generally made with a long term vision.

Investment Platforms:

Recently, many investment platforms and crowdfunding platforms have empowered ordinary people with startup investment capabilities. Now, any average person can invest in startups via such websites. These platforms offer a curated list of promising startups and require varying minimum buy-ins.

Conclusion

With every passing day, the number of startups grows considerably, making it difficult for independent angel investors to identify businesses with great growth potential and committed founders. Online platforms have stepped in by taking on the responsibility of analyzing the startup and the market, thereby relieving investors of this burden. They also provide a trustworthy ecosystem where potential investors can connect with founders and fund them while being assured of investing in a high return-to-risk investment opportunity.

Madhukar Bhardwaj

VP – BD & Investments, IPV

Madhukar Bhardwaj is a Business Management expert with more than 10+ years of expertise in E-commerce, Entrepreneurship, and Financial Markets Trading. He is the Vice President of Business Development & Investments in Inflection Point Ventures, a prominent Angel Investing Platform in India.